On 23 July 2021, when shares of food-tech company Zomato listed on Indian stock exchanges with a gain of 66% over the issue price, and a valuation above 1 trillion, some heralded a new phase for Indian internet businesses. Five more internet businessestypically, visible and fast-growing, but bleedingfollowed Zomato to sell shares to the public at rich valuations, in the process offering exits to institutional investors who had shepherded them till then. Two years on, public investors stand singed, private capital faces animosity, and companies are under scrutiny. The silver lining of that episode of excesses is that these listed businesses, chastened by that experience, are shaping stronger business fundamentalsthe time-tested way to draw investors.

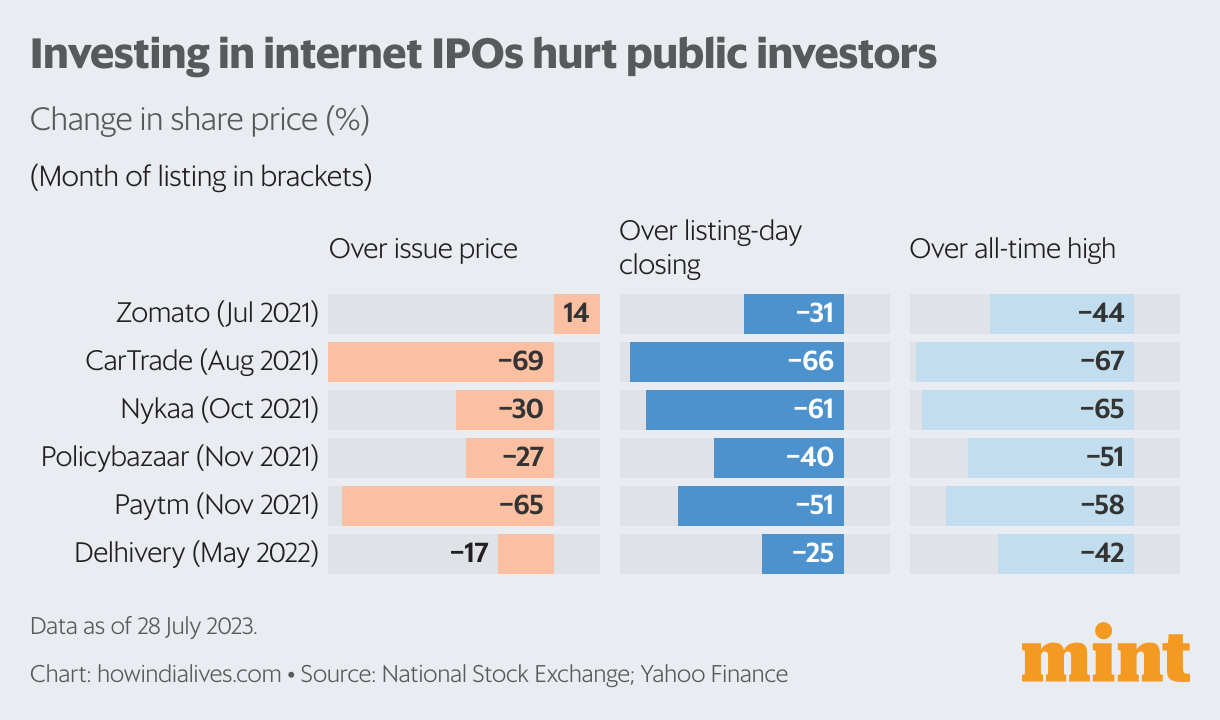

Public investors will take some winning over. In their spreadsheets, the returns column at three measuring points for these six internet businesses is awash with red. Only Zomato is above issue price. Current losses over listing-day closing range from 25% to 66%. Meanwhile, the benchmark BSE Sensex has been mostly steady, and is up 25% over July 2021 levels.

Lately, some of these internet stocks have clawed back. In the past six months, for example, Zomato is up 74% and fintech company Paytm 43%. This rise comes in the backdrop of companies focusing on growth that is robust, sustainable and, increasingly, self-sustaining. One measure of this is the net cash flow from operationsactual cash a business generates (positive value) or needs infusion of (negative value) to keep going. And there has been much improvement on this count.

Importance of cash

Paytms operations, for example, have gone from needing a cash infusion of 1,236 crore in 2021-22 to generating 415 crore of surplus cash. Logistics company Delhivery has gone from needing 240 crore to needing just 27 crore. While there are significant improvements in cash generation across the board, four of these six internet businesses are still burning cash at an operating level.

Cash burn should also be seen relative to revenue growth, where strong gains are seen. Take Zomato, whose cash burn in operations increased from 693 crore in 2021-22 to 844 crore in 2022-23. Although it burnt 22% more cash, its growth in revenues has far outpaced its growth in cash burn. In other words, Zomato has managed to scale up while requiring a relatively lower level of external cash support than before. Similarly, Paytm and insure-tech company Policybazaar have also turned in strong growth in 2022-23.

Robust growth

In the last two years, these companies grew at a speed where they doubled in size between one and three years, which is top-notch growth. At the same time, their share valuations dropped 42% to 67% from their all-time highs. The combined effect of these two movements makes these businesses better investment propositions than they were, say, at the time of their listing.

One measure of this is the market capitalization-to-revenue multipleor the level at which the stock market values each revenue rupee of a business. At Zomatos issue price, two years ago, this ratio for the company on its 2020-21 revenues was 49. Today, on its 2022-23 revenues, this is down to a respectable 9.6. A similar downward correction is seen for the other five businesses, and the range is now 3.9 to 11.5. This multiple for Reliance Industries is 1.8 and 5.4 for ICICI Bank.

Hype to sanity

Each company in this set had a core businessfor example, food delivery for Zomato, digital payments for Paytm. Even as they continue to build this core piece, revenue diversification has become a key tenet of growth. This partly comes from the pressures of being a listed stock and justifying rich valuations, and partly from extensions a core business offers.

Take Zomato. Even as its food-delivery business is expanding, its B2B supplies vertical (Hyperpure) and quick commerce vertical (Blinkit) are both contributing more to its topline.

Food delivery is close to operational profitability, the other two not so much. The question before Zomato, and other businesses, is how can they sustain this high growth and also turn profitable. Cash is not an issue, as the IPOs gave them an abundance of capital. But the investor needle to judge internet businesses has shifted from hype to sanity.

www.howindialives.com is a database and search engine for public data

#Internet #IPOs #Rush #retreat #regroup

Image Source : www.livemint.com