What happens when the hype subsides? This is what investors should be wondering about Google’s parent company Alphabet (GOOG 0.70%)(GOOGL 0.71%).

There’s no question that the company was caught with its pants down when OpenAI introduced ChatGPT. Microsoftit capitalized, investing billions to bring the large language model (LLM) chatbot to its Bing search engine. Many companies have tried and failed over the years to protect themselves from the Google Search domain, but this is a real threat… right?

But with monthly traffic dropping 10% in June, users spent less time on the site on average than ChatGPT. And iPhone downloads are down an astonishing 38%. So the ChatGPT buzz is already calming down.

Meanwhile, the latest report from Statista shows that Google Search has gained ground in recent months, holding 85.5% of the desktop market to Bing’s 8.2%. So Google is much harder to dethrone than many seem to think.

Alphabet stock is lagging behind the recovery

Tech stocks have rebounded well over the past year as artificial intelligence (AI) opportunities, slowing inflation and resilient earnings have sparked optimism. But Alphabet stock has lagged behind its peers, as shown below.

GOOG data on the total return level of YCharts.

Much of the delay is due to sentiment; several analysts cut their ratings on the stock, citing AI threats. But Alphabet is far from being left out of the AI race. He has been developing AI solutions with some of the brightest minds in the industry for years and recently merged his teams into one called Google DeepMind.

Its next-generation LLM, PaLM2, was recently introduced and promises higher-level reasoning, coding and language generation for use in more products such as the Bard chatbot, Google Docs and cybersecurity applications.

When the market realizes that Alphabet is actually an AI leader, sentiment could turn on a dime.

Are Google shares a purchase?

Sometimes the strength of the underlying business gets lost in the conversation. It’s easy to forget that Alphabet generates massive cash flow from operations: $91 billion in each of the prior two years plus $24 billion in the first quarter. So the business is very strong.

CEO Sundar Pichai is working to make the company 20% more efficient and more agile. The first quarter showed the plan in action as the company took in $2.6 billion in downsizing-related expenses. The Google Cloud segment also showed its first-ever operating profit in the quarter. This segment grew sales 28% year-over-year amid a challenging economy, after doubling revenue from $13 billion in 2020 to more than $26 billion in 2022.

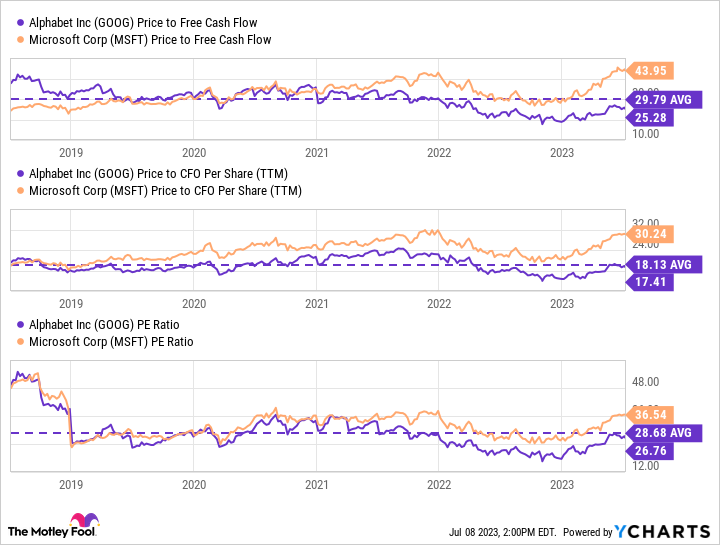

Meanwhile, as illustrated below, Alphabet lags both Microsoft and its historical averages in terms of price-to-earnings (P/E) ratios and multiple cash flow ratios.

GOOG data on YCharts price free cash flow. TTM = last 12 months.

Investors also benefit from Alphabet’s lucrative share buyback program. The company has used its significant cash flow to take $155 billion worth of shares off the market, or 10% of the current market capitalization, since 2020. That means shareholders will benefit even more when ad dollars return and profits will increase.

Actions like Nvidia and Microsoft are the talk of Wall Street and Main Street. But to paraphrase famed hockey player Wayne Gretzky, we shouldn’t be skating where the puck is; we have to skate where he is going.

With its AI initiatives, stranglehold on search, crazy cash flow, and profitable and growing cloud segment, all signs point to Alphabet.

Randi Zuckerberg, former director of market development and spokesperson for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, serves on the board of directors of The Motley Fool. Suzanne Frey, an executive at Alphabet, is a member of the board of directors of The Motley Fool. Bradley Guichard has positions at Alphabet and Microsoft. The Motley Fool has positions and recommends Alphabet, Meta Platforms, Microsoft and Nvidia. The Motley Fool has a disclosure policy.

#word #warning #betting #stock #poised #soar #motley #fool

Image Source : www.fool.com