The Zacks Internet – Participants in the content industry like it Airbnb (ABNB – free report), RELX extension (RELX extension – Free Report) e Perion network (PERIOD – Free Report) are benefiting from robust demand for digital offerings, as well as the growing importance of video content and cloud-based applications. These companies are also expanding their presence across social media, display and connected TV, and search, driving revenue growth. However, the sector has been impacted by the turnaround caused by the pandemic, coupled with challenging macroeconomic conditions globally. Persistent inflation and higher interest rates are having a negative effect on advertising spending, the main source of revenue for industry participants. The ongoing war between Russia and Ukraine has been a protrusion on the prospects of industry participants in Europe.

Sector description

The Zacks Internet – Content industry includes video coding platform providers, personal services, Internet content and information, staffing and outsourcing services, publishing, capital markets, media, in-home services, digital insights and measurement, stock photos, video and music licensing, and online travel companies. The industry is witnessing a rapid change in consumer behavior and ongoing digitalisation. Advertising is a major source of revenue for industry participants. Therefore, these companies are looking to expand their digital presence to acquire customers. They are also expanding their presence across social media, display and connected TV, and search. In addition to the United States, a number of companies in this sector are located in Israel, the United Kingdom, Germany, Russia and China.

3 Trends Shaping the Future of the Internet – Content Industry

Demand for digital offers growing: The industry is characterized by rapid technological change, frequent product and service introductions, and evolving standards. An expanding range of mobile, digital and cloud-based offerings from industry participants is a major driver of growth. Furthermore, the proliferation of smart devices and the growing automation of the application development process bode well.

The industry outlook is driven by the ad spend rate: Industry players are focusing on marketing efforts to drive traffic to websites. Advertising and subscriptions are the main sources of revenue for these companies. Additionally, the industry depends on consumer spending trends, making holiday spending a major deciding factor. The reopening of economies is driving the recovery in ad spending, which bodes well for industry players in the long run. However, macroeconomic challenges, the lingering effects of the pandemic, raging inflation and higher interest rates are expected to hurt ad spending in the near term.

Rising regulations March outlook: Industry players involved in online search and other social networking activities are increasingly under regulatory pressure, particularly in China and the European Union (“EU”). The Chinese government has a number of regulations related to direct mail, which is a major source of revenue for these companies. The implementation of the General Data Protection Regulation, which entered into force on 25 May 2018 in the EU, adds to the concerns. The California Consumer Privacy Act, which restricts the sale of user data, among other things, is another headwind for industry participants.

Zacks’ industry grade indicates bright prospects

The Zacks Internet – Content industry is hosted within the larger Zacks Information and Technology sector. He carries a Zacks Industry Rank #93, which places him in the top 37% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is the average of the Zacks Rank of all member stocks, indicates bright near-term prospects. Our research shows that the top 50% of industries Zacks ranked outnumber the bottom 50% by a factor of more than two to one.

Before introducing some stocks that you may want to consider for your portfolio, let’s take a look at the recent stock market performance and sector valuation picture.

The sector outperforms shareholder returns

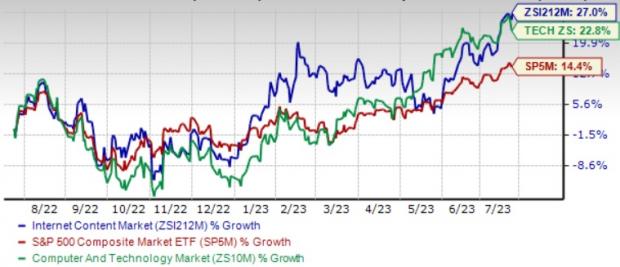

The Zacks Internet – Content industry has outperformed the broader Zacks Computer and Technology sector, as well as the Zacks S&P 500 composite, over the past year.

The sector grew 27% during this period compared to 14.4% growth in the S&P 500 and 22.8% for the broader sector.

Price performance over one year

Current industry rating

Based on the past 12 months’ price-to-sales (P/S) ratio, which is a multiple commonly used to evaluate Internet – Content stocks, we see that the sector is currently trading at 6.50x compared to the S&P 500’s 3.92x and the sector’s 4.34x.

Over the past five years, the sector has traded as high as 15.58x and as high as 4.72x, with a median of 8.22x, as the charts below show.

Price/sales (P/S) ratio for the last 12 months

3 internet stocks to buy

Airbnb: This San Francisco-based company is benefiting from strong demand in the travel industry. The continued strength of Nights & Experiences Booked across all regions, especially the Asia-Pacific region, remains a tailwind. Furthermore, the increase in nights booked in dense urban areas is a positive factor.

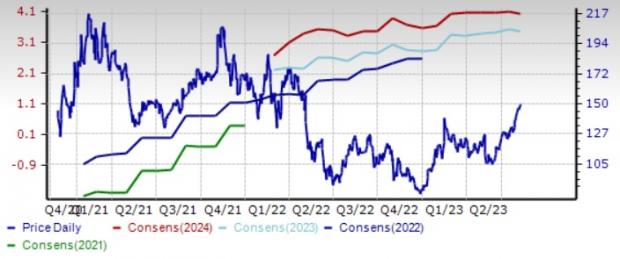

Zacks Consensus Estimate for this Zacks Rank #1 (Strong Buy) company’s 2023 earnings was down 1.1% to $3.47 per share over the past 30 days.

Shares of Airbnb are up 74% year-to-date.

Price and consensus: ABNB

Perion: This Israel-based global technology company delivers online advertising and search monetization solutions to brands and publishers in North America, Europe and internationally. Perion is committed to providing digital advertising solutions to capture consumers’ attention and drive engagement, as well as deliver ads across a portfolio of websites and mobile applications.

Perion is benefiting from strong demand for its video solutions. For the second quarter of 2023, revenue is expected to grow 20% and Adjusted EBITDA to increase 40%.

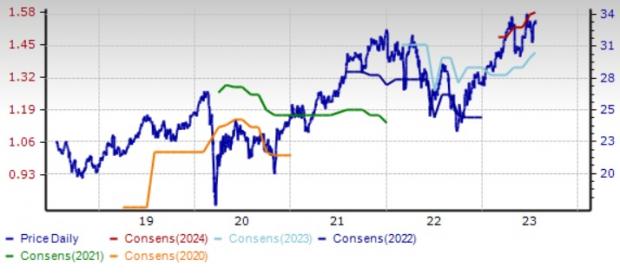

Zacks Consensus Estimate for this Zacks Rank #2 company (Purchase)’s 2023 earnings increased 3.2% to $2.93 per share over the past 30 days.

Shares of Perion are up 34% year-to-date.

Price and consensus: PERI

RELX extension: This London-based analytics and decision-making tools provider is benefiting from expanding customer base. The strong adoption of Lexis+ has been a major growth driver in the legal and corporate end markets. RELX is riding an expanding product portfolio.

Zacks’ consensus estimate for this Tier 2 company’s 2023 earnings is up 4.4% to $1.42 per share over the past 30 days.

Shares of RELX gained 20.8% in the year-to-date period.

Price and consensus: RELX

#internet #stocks #buy #thriving #industry

Image Source : www.zacks.com